The Mask Of Wealth

From Janitor to Millionaire, Elite to Bankruptcy

Welcome to my 30th blog post! Click here to read more from previous posts.

“I have been devastated by the financial crisis which came to a head in March 2008. I currently have no income.”

You may find it surprising that these words came from Richard Fuscone, a former executive of Merill Lynch, and not from someone with a low-paying job. So how did his financial downfall occur?

In our materialistic world, people often evaluate others based on external factors like appearance, wealth, and social status. This societal pressure sometimes leads individuals towards a preference for a lavish lifestyle, resulting in an unhappy outcome due to poor financial management — a lesson often seen among celebrities or sports stars.

On the other hand, those who understand the true source of happiness and prioritize their core values, avoid falling into the trap of consumerism.

In today's blog post, we will explore two stories about Richard Fuscone, a successful and wealthy man, and Ronald Read, an ordinary janitor which exemplify two contrasting lifestyles and outcomes.

Ronald Read - The humble millionaire

Source: Wall Street Journal

Ronald Read's life may not boast extraordinary highlights on the surface. From humble beginnings, growing up in a poor family, to serving in the military during World War II, and eventually becoming a janitor and gas station attendant, his path was unremarkable to many. However, it was only upon his passing in 2014 that the public discovered the astonishing truth about his financial success—a fortune of $8 million left in his testament.

The beneficiaries of his wealth were a testament to his compassionate nature, as he bequeathed $2 million to stepchildren, caregivers, and friends, $4.8 million to Brattleboro Memorial Hospital, and $1.2 million to Brooks Memorial Library. With no high-paying salary as a blue-collar worker, the question arose: What was Ronald Read's secret to accumulating such a vast fortune? Surprisingly, there was no elusive secret behind his success. His wealth was the result of living a frugal life with unwavering discipline, prudent lifestyle choices and consistent investing.

Regarding his investing strategy, it wasn’t sophisticated but remarkably effective. Ronald Read invested in familiar blue-chip stocks that paid dividends, diversifying across various industries. The key to his approach was patience—holding onto these stocks for the long term and reinvesting his dividends to buy more shares. Over 65 years, he consistently invested a total of $273,000, which astonishingly grew into approximately $8.3 million.

Despite becoming a millionaire, Ronald Read remained unassuming and continued to live modestly below his means. There was a story that when he was at Friendly’s restaurant, a patron paid for his meal as this patron thought he couldn’t afford for the meal. It’s the illustration to his unpretentious lifestyle. He stands as a living example, encouraging middle-class individuals to strive for wealth through modest living and consistent long-term investments.

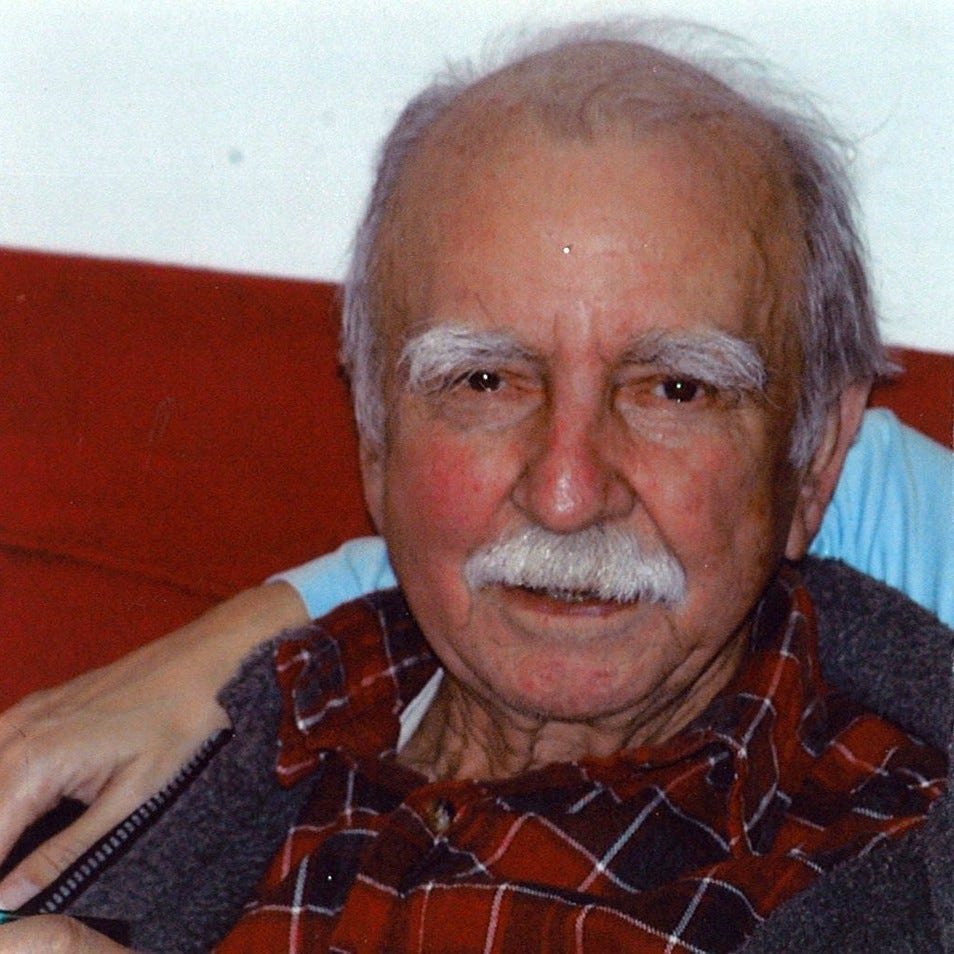

Richard Fusone - The lavish millionaire

The simple thing we can talk about Richard Fuscone is the contrast with Ronald Read on every aspect, from their educational backgrounds, occupations, social prestige, lifestyles to their outcomes. While Richard Fuscone was once listed as one of the 40 most successful individuals under 40 by Crain’s New York magazine and held prominent positions in the financial industry as the former Chairman and President of Merill Lynch Money Market Inc, he declared bankruptcy in 2010. On the other hand, Ronald Read, an ordinary janitor, managed to accumulate a considerable fortune through disciplined financial habits.

Source: Crain’s New York

Richard Fuscone had a thriving career as a Wall Street investment banker. In 2000, he retired to pursue other personal and charitable interests. However in 2010, he faced financial ruin, declaring bankruptcy and selling his $32 million mansion for just $8 million to pay off debts. The financial crisis of 2008 played a role, but it was his lavish lifestyle that ultimately led to his downfall. His opulent spending, such as borrowing $12 million for a house expansion from Patriot National Bank in 2005, which became one of the biggest mansion in Greenwich, and hosting extravagant parties, left him unable to sustain his lifestyle when his business failed during the crisis. As the result, he was unable to afford his $66,000 a month mortgage, leading to bankruptcy declaration. After all, he was left with debts of $13.8 million.

“The only source of liquidity is whatever my wife is able to sell in terms of personal furnishings.” Mr. Fuscone said in a plea to the court to borrow $500,000 to meet his expenses.

His story serves as a stark reminder that no matter how financially savvy you may be, sustainable wealth requires discipline in lifestyle choices. The financial crisis and macroeconomic conditions may be unpredictable, but controlling your lifestyle is within your power. Richard Fuscone's tale underscores the importance of living within one's means and practicing financial discipline, regardless of one's financial knowledge. Otherwise, even those with significant financial expertise can find themselves vulnerable and facing dire consequences in challenging times.

The lessons from both stories

1. Seeking authenticity over social validation

Take a moment to ponder why people often feel compelled to wear expensive clothes, accessories, or drive luxurious cars. Is it not often driven by a desire for external recognition and validation? Yet, the more you rely on external factors to validate your self-worth, the less genuine your sense of self-esteem becomes. True happiness and fulfillment in life lie in discovering your core values and living in alignment with them. Embracing your authenticity and embracing what truly matters to you is the key to unlocking true happiness and contentment.

2. Your lifestyle matters more than your profession

Living a life of consciousness, discipline, and humility can have a more significant impact on your overall well-being and financial success than the job you hold. Ronald Read's inspiring journey from being a janitor to becoming a millionaire challenges the stereotype that wealth is only attainable through high-paying jobs. His story serves as an inspiration for the middle class, proving that with prudent financial habits, anyone can achieve financial independence. Ronald Read's success highlights the importance of living within your means, saving diligently, and investing for the long term.

On the other hand, the cautionary tale of Richard Fuscone reminds us that present financial status does not guarantee future success. His lavish lifestyle and high financial status did not shield him from bankruptcy. This serves as a potent reminder that staying committed to responsible financial practices and maintaining discipline in life are crucial, regardless of your current wealth.

3. The saving habit sets the blueprint for success

The stories of Ronald Read and Richard Fuscone illustrate the crucial role of saving and prudent financial habits in achieving long-term success. Cultivating the saving habit, no matter how modest the amount, can lead to significant gains over time. By setting aside a portion of your income and investing wisely, you can create a solid foundation for financial security and potential wealth.

A practical formula like 50/30/20 (needs/wants/savings) can guide your personal finance management, ensuring a solid foundation for financial security and potential wealth. The more you save and invest, the stronger your financial position becomes.

4. The pitfall of lavish spending lays ground for failure

Excessive spending, even for those with substantial incomes like Richard Fuscone, can lead to a life of financial instability and stress. Often, the pursuit of immediate gratification through extravagant purchases can overshadow the need for responsible financial planning. Without a prudent approach to money management, you may be trapped in a cycle of debt and struggle, particularly during unexpected circumstances.

5. Think long-term for compound effect

What contributed in the success of Ronald Read? There was no any special thing rather than his discipline and patience in the long-term investments.

"The secret to wealth is simple: Save early and often, and let compounding do the heavy lifting." - John C. Bogle

While he did not possess sophisticated financial knowledge, he embraced the power of compounding. Read's approach to investing might have aligned with Warren Buffett's philosophy of holding great companies for the long term, as Buffett himself started investing at a young age and understood the power of compounding. Ronald Read applied this principle with exceptional discipline and patience, recognizing the potential it held for significant financial growth over time.

6. Find the balanced approach

Achieving financial success lies in striking a balance between saving for the future and enjoying the present. It's essential to set realistic financial goals, build an emergency fund, and invest wisely for the long term. Simultaneously, treating yourself occasionally to experiences and possessions that bring joy can enhance overall well-being. The key is to be conscious of your spending decisions and prioritize financial responsibilities.

Ronald Read and Richard Fuscone may not have had any connections, and their stories may appear paradoxical, but when juxtaposed, they create a compelling illustration of personal financial literacy. They demonstrate how appearances can be deceiving when it comes to financial success. The key takeaway is that the habit of saving and making informed financial choices are crucial factors in determining your financial well-being. By understanding the consequences of both lavish spending and prudent saving, you can make informed decisions that lead to a more secure and prosperous future. Remember, what you see on the surface is not always an accurate representation of financial wisdom and success.

That’s all for today. Till next week!

Cheers,

Do Thi Dieu Thuong